Traditional Ira Contribution Limits 2021

Traditional Ira Contribution Limits 2021. Contribute to an individual retirement plan like a roth ira or traditional ira? Employees can defer $23,500 into workplace plans, a modest increase from $23,000 in 2024.

If you file taxes as a single taxpayer, your deductions are fully deductible as long as. Traditional 401(k) and roth 401(k) limits.

Traditional Ira Contribution Limits 2021 Images References :

Source: mungfali.com

Source: mungfali.com

Ira And Retirement Plan Limits For 2021 60C, The limit on annual contributions to an ira remains $7,000.

Source: due.com

Source: due.com

3 Types of IRAs Due, Learn how they are determined and how you can fund these accounts.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Roth IRA Limits And Maximum Contribution For 2021, For both tax years 2020 and 2021, those under the age of 50 can contribute up to $6,000 in total to traditional and roth ira accounts per tax year.

Source: skloff.com

Source: skloff.com

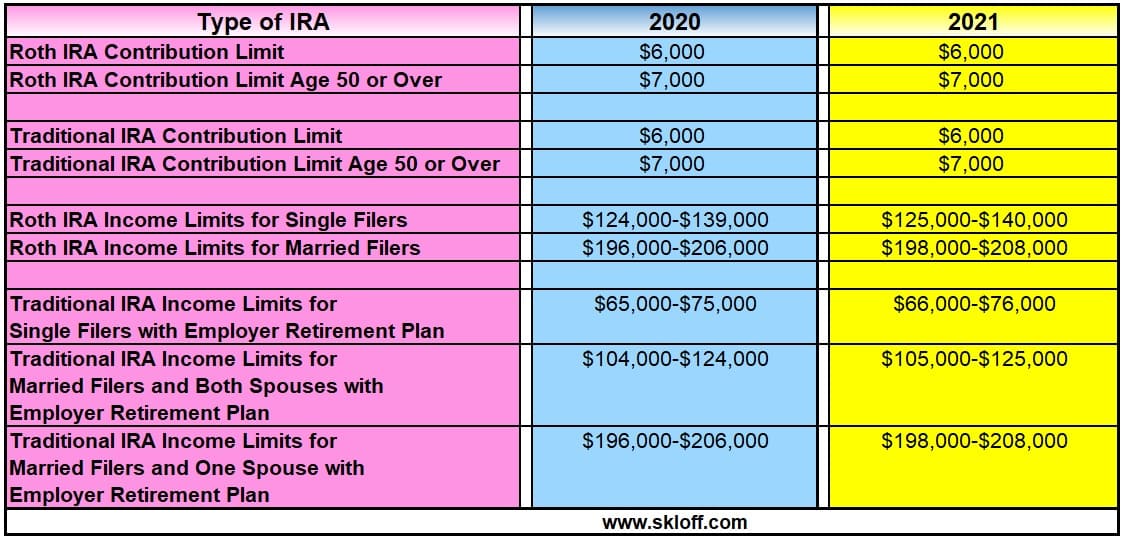

IRA Contribution and Limits for 2020 and 2021 Skloff Financial, Here’s the breakdown for the 2021 ira contribution limit.

Source: www.youtube.com

Source: www.youtube.com

2021 Contribution Limits Roth IRA Traditional IRA 401k YouTube, Contributions you make to a traditional ira may be fully or partially deductible, depending on your filing status and income, and generally, amounts in your traditional ira.

Source: choosegoldira.com

Source: choosegoldira.com

traditional ira contribution limits Choosing Your Gold IRA, Here are your retirement contribution limits for 2021.

Source: www.begintoinvest.com

Source: www.begintoinvest.com

2021 IRA, 401k, and Roth IRA contribution limits Roth IRA eligibility, You can contribute if you (or your spouse if filing jointly) have taxable compensation.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Is A Backdoor Roth IRA A Good Move For Higher Earners?, Contributions you make to a traditional ira may be fully or partially deductible, depending on your filing status and income, and generally, amounts in your traditional ira.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS announced its Roth IRA limits for 2022 Personal, Workers age 50 and older can.

![2021 IRS HSA, FSA and 401(k) Limits [A Complete Guide] 2021 IRS HSA, FSA and 401(k) Limits [A Complete Guide]](https://www.griffinbenefits.com/hs-fs/hubfs/2021_Retirement_401k_IRS_Contribution_Limits.jpg?width=1267&name=2021_Retirement_401k_IRS_Contribution_Limits.jpg) Source: www.griffinbenefits.com

Source: www.griffinbenefits.com

2021 IRS HSA, FSA and 401(k) Limits [A Complete Guide], Those age 50 or older can.

Posted in 2024