Estate Income Tax Brackets 2024

Estate Income Tax Brackets 2024. As of 2024, estate income tax rates are progressive, meaning the percentage of income subject to taxation increases as income levels rise. A higher exemption means more estates may be exempt from the federal tax this.

Irs tips for 2024 | pay tax. In other words, someone with $100,000 in taxable.

For 2024, The Federal Estate Tax Threshold Is $13.61 Million For Individuals, Which Means Married Couples Don’t Have To Pay Estate If.

Estate and gift tax planning for 2024 should focus on understanding the updated exemption limits, including.

Here Are The Key Highlights That Can.

The types of taxes a deceased taxpayer’s.

The Estate Tax Ranges From Rates Of 18% To 40% And Generally Only Applies To Assets Over $13.61 Million In 2024.

Images References :

Source: printableformsfree.com

Source: printableformsfree.com

2023 Form 1040 Tax Tables Printable Forms Free Online, Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2022. That means, for 2024, you’ll pay 10% on your first $23,200, then 12% on dollars 23,201 to 94,300, and so on.

Source: 2023bgh.blogspot.com

Source: 2023bgh.blogspot.com

10+ 2023 California Tax Brackets References 2023 BGH, As of 2024, estate income tax rates are progressive, meaning the percentage of income subject to taxation increases as income levels rise. See current federal tax brackets and rates based on your income and filing status.

Source: incomrae.blogspot.com

Source: incomrae.blogspot.com

What Are Tax Brackets, The federal estate tax exemption amount went up again for 2024. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2022.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

95,000 a Year Is How Much an Hour? Top Dollar, The federal estate tax exclusion for decedents dying will increase to $13,610,000 million per person or $27,220,00 million per married. You pay tax as a percentage of your income in layers called tax brackets.

Source: www.hotixsexy.com

Source: www.hotixsexy.com

Oct 19 Irs Here Are The New Tax Brackets For 2023 Free Nude, As of 2024, estate income tax rates are progressive, meaning the percentage of income subject to taxation increases as income levels rise. Last updated 24 april 2024.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

tax brackets for estates and trusts for 2023 & five earlier years, Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2022. Estate and gift tax planning for 2024 should focus on understanding the updated exemption limits, including.

Source: www.newretirement.com

Source: www.newretirement.com

2026 Tax Brackets Why Your Taxes Are Likely to Increase in 2026 and, These tax levels also apply to all income generated by estates. For 2024, the federal estate tax threshold is $13.61 million for individuals, which means married couples don’t have to pay estate if.

What tax bracket am I in? Here's how to find out Business Insider Africa, There are seven income tax rates for the 2024 tax year, ranging from 10% to 37%. Thirteen states levy an estate tax.

Source: greenbayhotelstoday.com

Source: greenbayhotelstoday.com

Tax Brackets for 20232024 & Federal Tax Rates (2024), Just as the leaves fall and the air grows crisper, the irs has unveiled crucial adjustments to tax brackets, credits, and deductions. 2024 federal income tax brackets and rates.

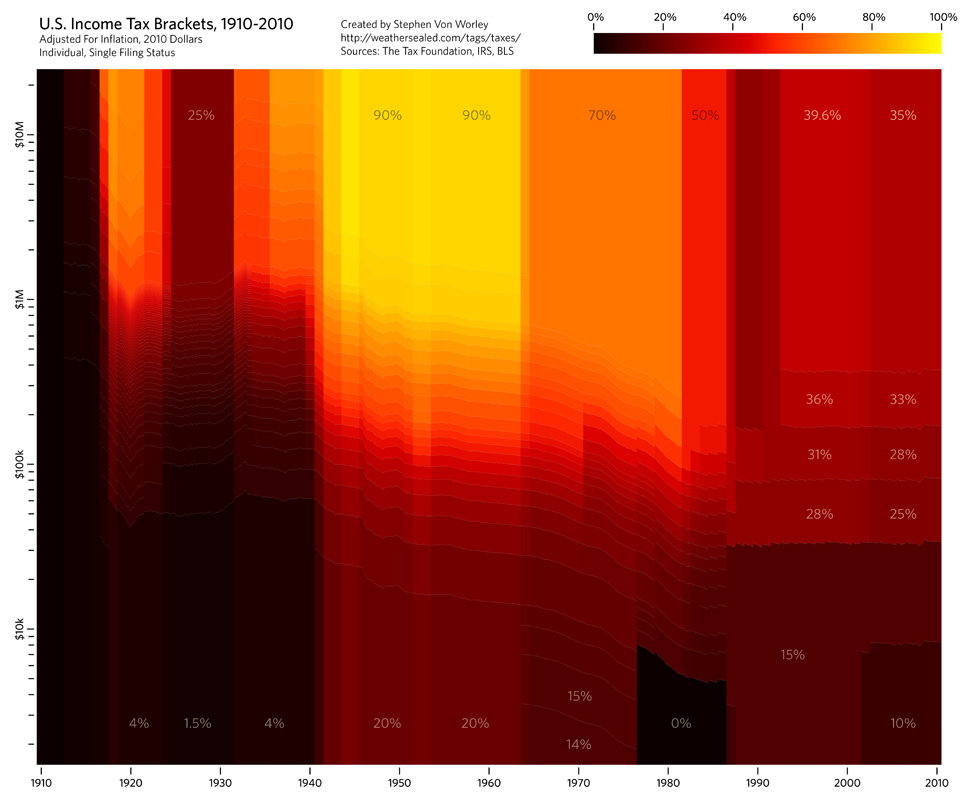

Source: flowingdata.com

Source: flowingdata.com

Tax brackets over the past century FlowingData, The types of taxes a deceased taxpayer's. Below is a breakdown of these.

The Types Of Taxes A Deceased Taxpayer's.

The federal estate tax exemption amount went up again for 2024.

See Current Federal Tax Brackets And Rates Based On Your Income And Filing Status.

You pay tax as a percentage of your income in layers called tax brackets.